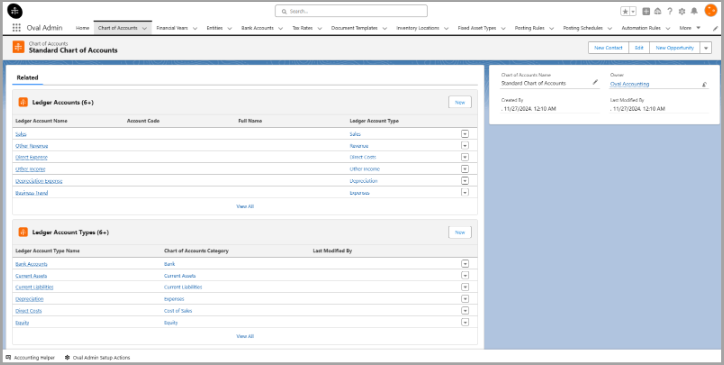

The trial comes with a default set of Standard Chart of Accounts. If you click on the Chart of Accounts tab, and select ‘All’ from the list view, the Standard Chart of Accounts is listed. Click this and you will see the Ledger Accounts and the Ledger Account types that are associated with this COA.

You can add new Ledger Accounts and Ledger Account types by clicking on the relevant ‘New’ button.

You can also create your own independent Chart of Accounts from the main COA tab, and selecting the ‘New’ button.

Posting Rules and Schedules

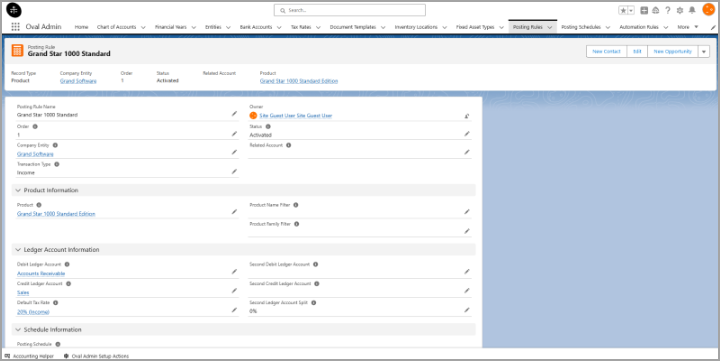

Posting Rules link transactional records with the Chart of Account. If you select ‘All’ from the list view within the Posting Rules tab, you will see a list of all Posting Rules that have been provided by default for the trial.

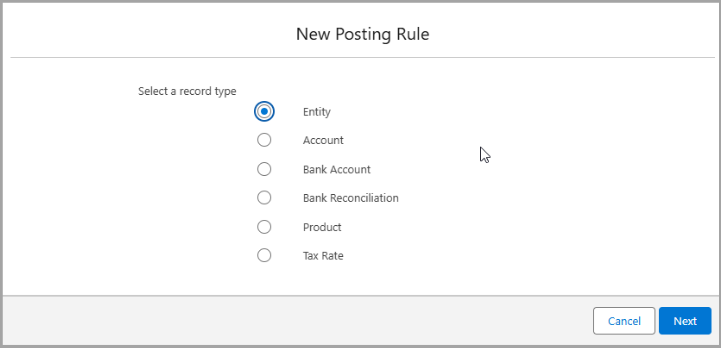

If you click on the ‘New’ button, you will see that there are 6 different Posting Rule types for you to select and setup a rule for.

Bank Reconciliation allows you to create rules for how bank transactions are automatically reconciled. You can specify an Account the rule applies to, the Bank Account, filter on a reference and state the amounts from and to. You can also specify the dates that the transaction occurs between.

Products allows you to setup a posting Rule for a specific Product. You can specify the Transaction Type the rule applies to, the individual Product, and which Ledger Accounts should be credited and debited.

Entity Posting Rules allow you to specify key accounts in the Chart of Account. You can setup a Posting Rule for Accounts Payable or Accounts Receivable.

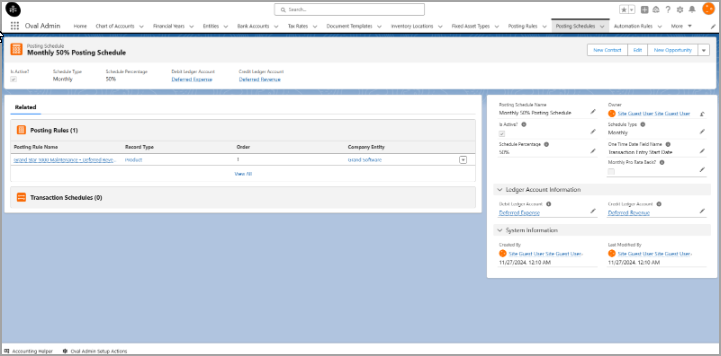

If you click on the Posting Schedule tab and select ‘All’ from the list view, you will see an example of a Posting Schedule has been provided as part of the trial.

You can specify when the Posting Schedule should run, the percentage of the net amount that should be posted and the ledger accounts that it applies to. As you can see in the example provided, the schedule applies to 1 different Product Posting Rule.

For further assistance setting up Chart of Accounts or Oval Accounting in general, please do not hesitate to contact us at hello@ovalaccounting.com

Article last reviewed: 2024-12-10