Sales Invoice Creation within Oval Accounting

The purpose of this document is to provide training for the Transactions feature within Oval Accounting. Step by step instructions will be provided to assist with the creation of a Sales Invoice Transaction. Note: Multi-Currency will need setting up first.

Use Case 1

Currency Euro = 0.95

Currency USD = 1.0

Create a new Sales Invoice and validate the transaction values are correct.

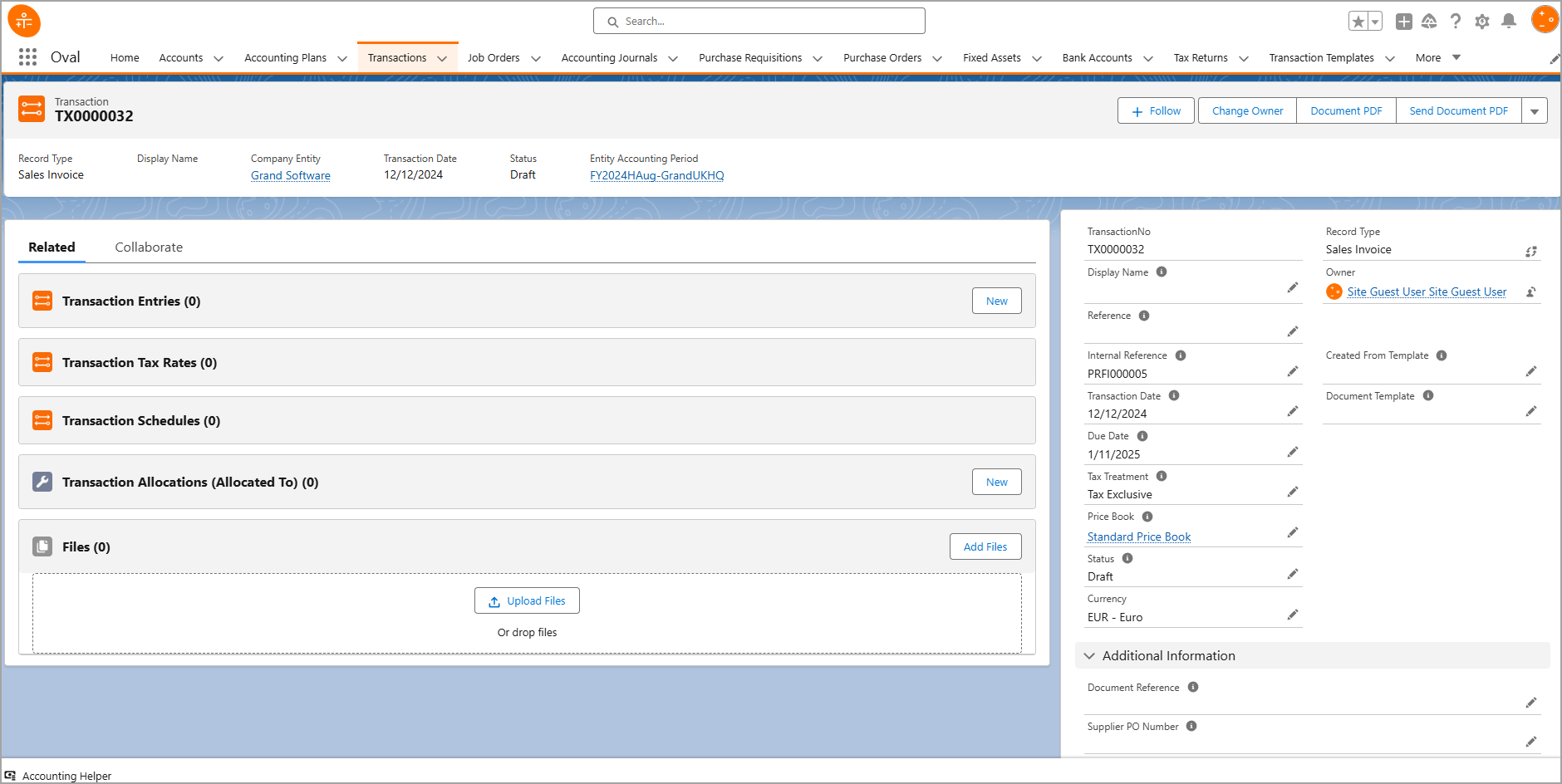

- Navigate to the Transactions tab in Oval Accounting.

- Click on New Transaction.

- Select the Transaction record Type of Sales Invoice.

- Click on Next.

- Select a date of Today.

- Select the currency of Euro.

- Search for the Company Entity (only if the Company Entity is not selected in the Accounting Helper).

- Search for the current Entity Accounting Period (only if the Company Entity is not selected in the Accounting Helper).

- Click on Save.

Next Steps:

- Click on New Transaction Entity.

- Select type Invoice.

- Change the Quantity to 3.

- Search or create a Product.

- Enter a unit price of 60.50.

- Change the currency to Euro.

- Select a Tax Rate of 20% Income.

- Search for a Ledger Account.

- Click on Save.

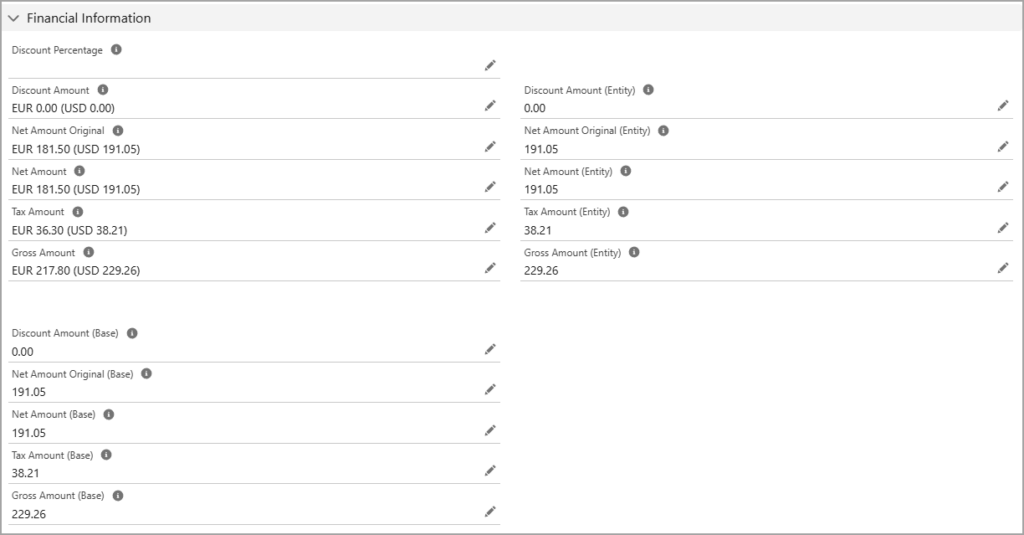

Validate the following values are displayed:

Net Amount = EUR 181.50 (USD 191.05)

Tax Amount = EUR 36.30 (USD 38.21)

Gross Amount = EUR 217.80 (USD 229.26)

For further assistance creating Transactions or Oval Accounting in general, please do not hesitate to contact us at hello@ovalaccounting.com

Article last reviewed: 2024-12-12